The introduction in a group life insurance consultation aims to create a positive and informative atmosphere, build trust with the participants, and set clear expectations for the consultation process.Itshould serve as a foundation for a productive discussion about insurance options and coverage.

INTRODUCTION (2 MINUTES)

CLEARLY INTRODUCE YOURSELF AND OUTLINE THE PURPOSE AND GOALS OF THE CONSULTATION. LET THE EMPLOYEE KNOW THAT YOU ARE THERE TO HELP THEM UNDERSTAND THEIR INSURANCE OPTIONS, MAKE INFORMED DECISIONS, AND WILL ALSO ADDRESS ANY QUESTIONS OR CONCERNS THEY MAY HAVE.

EMPLOYEE QUESTIONNAIRE (5 MINUTES)

TAKE A MOMENT TO ASK THE EMPLOYEE THE QUESTIONS FROM THE QUESTIONNAIRE FORM. INFORM THE EMPLOYEE THAT THE INFORMATION THAT THEY ARE GIVING YOU WILL ONLY BE USED TO BUILD THEIR CUSTOMIZED BENEFITS PACKAGE.

B-I-G BENEFITS (5 MINUTES)

EDUCATE EMPLOYEES ABOUT THE VARIOUS BENEFITS OF THE PRODUCTS AND ULTIMATELY HELP THEM MAKE INFORMED DECISIONS RELATED TO THE IMPORTANCE OF THEIR FINANCIAL SECURITY. HIGHLIGHT THE PRACTICAL AND EMOTIONAL ADVANTAGES OF HAVING A BENEFITS PACKAGE.

CLOSING (15 MINUTES)

CLOSING THE DEAL IN A GROUP LIFE INSURANCE CONSULTATION IS ESSENTIAL FOR PROVIDING FINANCIAL SECURITY FOR YOU AND THE EMPLOYEE! IF YOU DO NOT SUCCESSFULLY CLOSE DEALS, THE EMPLOYEE WONT HAVE THE IMPORTANT PROTECTION OUR BENEFITS PROVIDE AND YOU DONT RECEIVE COMMISSION. THIS CONSISTS OF COMPLYING WITH ALL LEGAL REQUIREMENTS WHILE GATHERING ALL OF NECCESSARY INFORMATION NEEDED IN ORDER TO GET THE EMPLOYEE INSURED.

The introduction in a group life insurance consultation aims to create a positive and informative atmosphere, build trust with the participants, and set clear expectations for the consultation process. It should serve as a foundation for a productive discussion about insurance options and coverage.

AGENT: Hello (employee name),

My name is (your name) with Barlow Insurance Group. I am a licensed insurance agent and

to assure your trust, my license number is (license number). I’m here today because (director and company) cares about you and would like to offer you some amazing benefits at a 70% discount rate. The provided benefits will protect you in the event of unexpected illness or injury. Today, my goal is to get you coverage and essentially explain these benefits. Lets keep in mind that there is nothing on this planet more valuable than you so considering that, you absolutely deserve protection.

Before we begin, lets complete your employee questionnaire. Any information you share with me today is guaranteed confidential. This will only be used to establish a customized benefits package for your needs. Please write down any questions or concerns that arise and I will be sure to address them. After our time together, I believe you will be confident, educated and understand the importance of having these benefits in place.

AGENT: (REFER EMPLOYEE TO THE “EMPLOYEE QUESTIONNAIRE” FORM AND COMPLETE)

AGENT: Mr./Ms. (employee name) while working with (name of company) if you suddenly get ill or find yourself involved in an accident and not able to work for an extended period of time, do you have enough money saved in order to cover your current expenses?

EMPLOYEE: (________)

AGENT: Most individuals would not be able to cover their expenses in the event of life’s unexpected circumstances like accident and sickness. Do you believe that (name of company) would be legally bound to still pay your salary or wages?

EMPLOYEE: (_________)

AGENT: Legally speaking, employers are not liable for your expenses and are only obligated to compensate you for time on the job. However, (name of company) actually values your life and your contributions which is why they are offering the opportunity for their employees to receive these amazing benefits at a 70% discount rate.

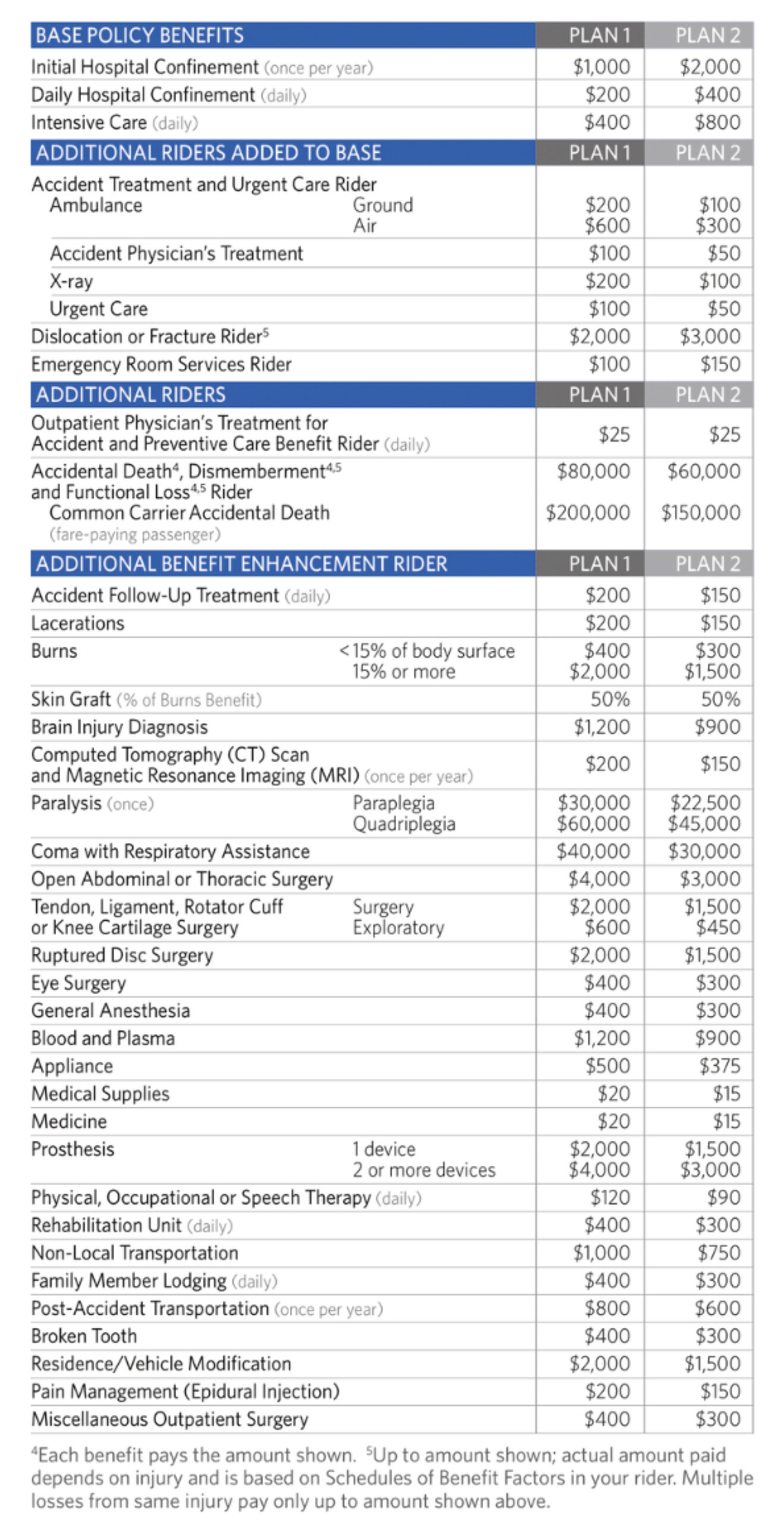

(REFER EMPLOYEE TO THE “B-I-G BENEFITS” FLYER AND EXPLAIN)

AGENT: Now that we have established a good understanding of our benefits, l’d like to go a little more in depth and assess the information that you’ve provided so that we can build your specialized benefits package. Please give me one moment to review your form.

*ACCESS THEIR PERSONAL INFORMATION*

AGENT: Let’s take a look at the investment package I put together for you.

(REFER EMPLOYEE TO THE “B-I-N-G-O BOARD” AND EXPLAIN YOUR SUGGESTIONS)

Explaining the importance of group benefits during a consultation highlights the financial, practical, and emotional advantages of their employers offering them these valuable benefits.

PAYS YOU CASH – ABOVE ANY OTHER INSURANCE

We go beyond traditional coverage by providing you with a cash benefit that can be used for various purposes. Unlike some policies that might only cover specific expenses, pays directly to health providers only, or reimburses you later, this policy pays you cash directly.

BENEFITS ARE GUARANTEED RENEWABLE

With guaranteed renewable benefits, you can have peace of mind knowing that your coverage will remain in place as long as you continue to pay your premiums. Our benefits provide stable and dependable coverage to our policyholders, allowing you to plan for the long term with confidence

PREMIUM RATE WILL BE LOCKED IN AND REMAIN CONSISTENT

Having a locked-in premium rate provides you with financial predictability and peace of mind, knowing that your insurance costs won’t suddenly increase, regardless of changes in your health or age. Consistency in premium rates is a key advantage of our group benefits.

POLICIES ARE PORTABLE – THEY GO WITH YOU EVERYWHERE

Whether you’re considering retirement, going back to school, or simply exploring new opportunities, knowing that your policy is portable offers you the flexibility and peace of mind to make career moves without worrying about losing this crucial protection.

NO NETWORKS – NO DEDUCTIBLES – NO CO-PAYS

Most health insurance demands that you cover a portion of the cost. We don’t require anything from you other than proof that you have incurred a loss from an injury or critical illness which can be as simple as an hospital bill or documentation provided by your physician.

The ideal way to conclude a consultation and propose life insurance to a client is to summarize the key benefits and protections that the specific policy offers, while addressing any concerns or questions the client might have. Then, present a clear call to action, emphasizing the importance of securing their family’s financial future and offering support throughout the application process.

AGENT: Mr./Ms. (employee name) l’d like to take a moment and give you the opportunity to ask any questions or voice your concerns? Is there anything I need to address further?

EMPLOYEE: (_________)

*CAREFULLY RESPOND TO ANY FURTHER QUESTIONS OR CONCERNS*

AGENT: Thank you for taking the time to discuss your financial goals and concerns with me today. Based on our conversation, it’s clear that ensuring the long-term security of you and your loved ones is a top priority. The life insurance policy we’ve discussed offers a comprehensive range of benefits, including financial protection for your family, coverage for outstanding debts, and support for future expenses. Additionally, it’s worth noting that by securing this policy now, you can take advantage of more favorable premiums and terms, saving you both time and money in the long run.

To complete the process we just have to submit your application and initial premium. After submission, the carrier will then need to approve your application before the policy can go into effect.

(BEGIN APPLICATION(S) FOR INSURANCE CARRIER)